News

Venture Capital

3 minutes

07/09/2023

Foresight Technology VCT launches new £15m share offer for FWT Share Class

Click here for the PDF version.

London, 6 September 2023: Foresight Group LLP (“Foresight”), a leading infrastructure and private equity investment manager, today announces the launch of a new offer for subscription to raise £15 million on behalf of Foresight Technology VCT plc (“the VCT” or “the Company”), with an over–allotment facility to raise up to a further £10 million through the issue of new shares. The Offer will be made through the issue of new Foresight WAE Technology (FWT) shares.

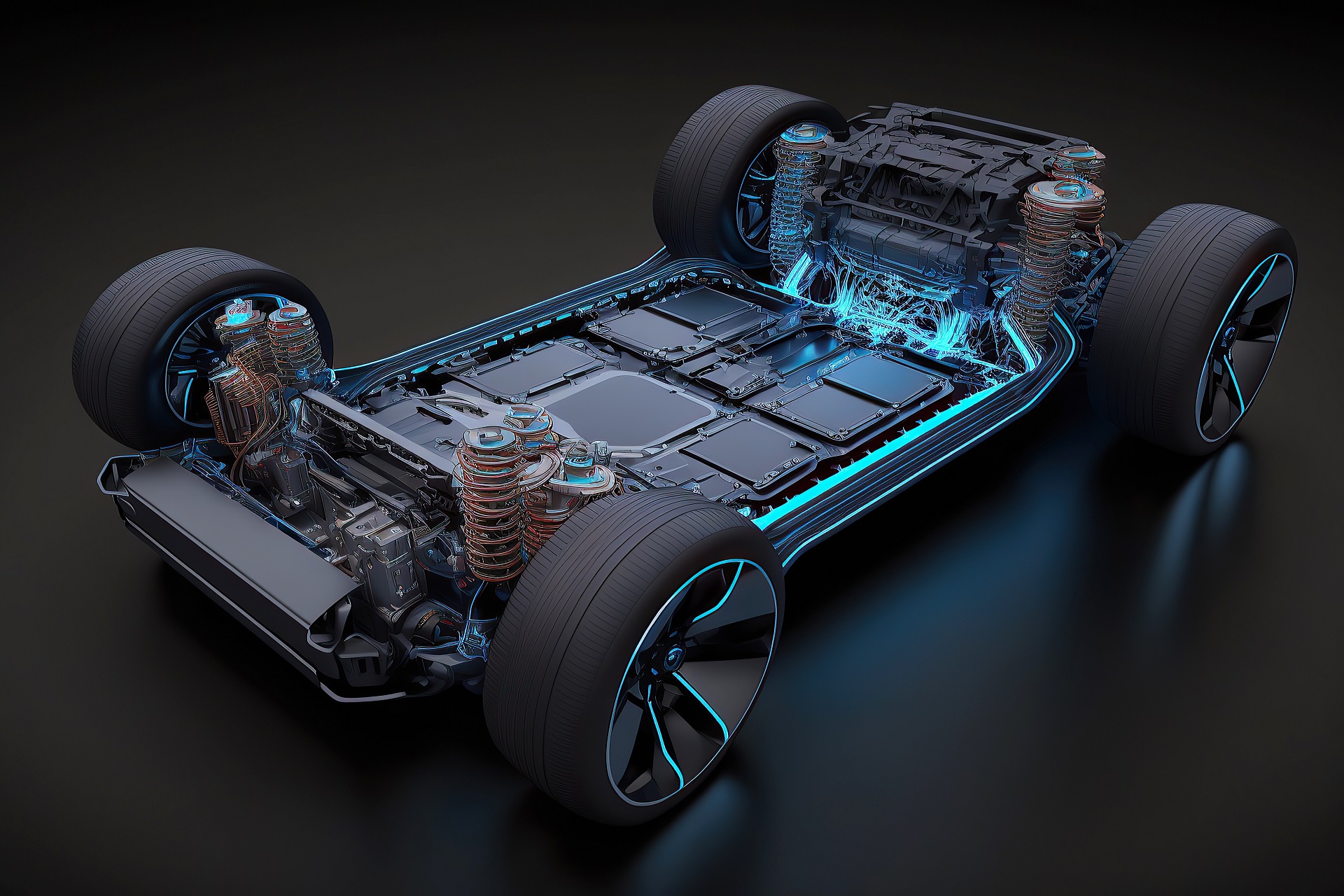

Launched in 2019, the FWT share class has now raised over £25m, providing investors with exposure to early-stage companies with strong intellectual property, operating in substantive markets where the combined expertise of WAE and Foresight can offer attractive added value potential. Investments seek to take advantage of vast opportunities that exist to improve the productivity, efficiency and environmental impact of nearly every industrial sector from manufacturing through to energy.

The VCT aims to provide an attractive income stream as well as allowing investors to benefit from the VCT tax reliefs available to qualifying participants.

Andy Bloxam, Managing Director, Venture Capital at Foresight Group, said: “Against a backdrop of high inflation and economic uncertainty, it is more vital than ever to support British businesses. The FWT Share Class has continued to achieve positive momentum over the past 12 months, with a number of investments into exciting, fast-growing firms at the forefront of their respective industries.”

“The fund has a unique approach, thanks to both the technical expertise of WAE and investment track record of the team here at Foresight. We have continued to back early-stage, innovative companies across multiple sectors, with recent successes including Codeplay, a software development company based in Scotland, and Flusso, a Cambridge university spin-out business. We have a growing number of exciting companies in our portfolio and look forward to continuing to support them while delivering results for our investors.”

-ENDS-

For more information contact:

Saffron Wainwright: foresight@citigatedewerogerson.com / +44 (0 7713 801 087

Will Easton: foresight@citigatedewerogerson.com / +44 (0) 7786 420 017

About Foresight Group Holdings Limited

Foresight Group was founded in 1984 and is a leading listed infrastructure and private equity investment manager. With a long-established focus on ESG and sustainability-led strategies, it aims to provide attractive returns to its institutional and private investors from hard-to-access private markets. Foresight manages over 350 infrastructure assets with a focus on solar and onshore wind assets, bioenergy and waste, as well as renewable energy enabling projects, energy efficiency management solutions, social and core infrastructure projects and sustainable forestry assets. Its private equity team manages eleven regionally focused investment funds across the UK and an SME impact fund supporting Irish SMEs. This team reviews over 2,500 business plans each year and currently supports more than 250 investments in SMEs. Foresight Capital Management manages four strategies across six investment vehicles with an AUM of over £1.4 billion.

Foresight operates in eight countries across Europe, Australia and United States with AUM of £12.3 billion*. Foresight Group Holdings Limited listed on the Main Market of the London Stock Exchange in February 2021. https://www.foresightgroup.eu/shareholders

*Based on Foresight Group unaudited AUM as at 31 December 2022.